Why Life Settlements Will Thrive Beyond 2021

Life settlements will have an important role to play in 2021 and beyond. COVID-19 has had a destabilising effect on many financial markets but has not had a dramatic impact on life settlements. However, it may still become a driving force for the life settlements market. We have outlined several potential driving forces in the […]

Purchasing Policies in the Tertiary Life Insurance Market

The tertiary market for trading life insurance policies is mostly the domain of institutional investors. Hence, it is a mistake to assume that all players have the same expertise, the same approach and the same expectations. That would be a mistake. Recent history has witnessed “household names” entering then exiting the market quickly. Entering the […]

Why invest with GI Asset Management?

As an experienced life settlements manager, we have listed 10 reasons you should partner with us. Being early participants in the industry we have witnessed the industry continually grow and adapt. We are here to guide you through your investment in the asset class. After working through some challenges related to regulation, capital flow, and […]

Why Buy US life settlements?

Since the origination of our fund, we have only ever considered US life insurance policies. What motivates us to buy US life settlements policies above all others? Below we name the most motivating features to consider the USA life policies for your life settlements investment. 1. The US Legislative Environment for Life Settlements The […]

5 Risks Unique to Life Settlements

Risk is a feature in any investment decision. There are risks that you can quantify and manage or mitigate and there are those that you cannot. First-time investors in life settlements are often not aware of the unique risks and opportunities only present in life settlements. It is reasonable to conclude that life settlements aren’t […]

ESG Investing with Life Settlements

Environmental, Social and Governance (ESG) refers to the three central factors in measuring the sustainability and ethical impact of an investment. Whilst, ESG investment has not yet reached mainstream status in some countries, it is fast becoming more than just a trend for many Australian investors, as noted during the AIMA Alternative Investment Conference-Australia. When […]

What do Investors Want from Alternative Investment?

This “New Normal” world if filled with low yields and low growth. It is not surprising that increasing allocations to alternative investment is the new mainstream rather than unusual. Asset Managers take note, during the recent AIMA Australia Annual Forum, one message came across loud and clear, ‘What value are you delivering to your investors?’. […]

Traded Life Policy Investments

To combat the relative illiquidity of the life settlement market, some investors are searching for the holy grail of a centralised traded life policy platform. Lack of liquidity is one of the key disincentives for investors new to the market. With historical volatility in traditional investments, a limited liquidity market makes some institutional investors uneasy. […]

6 Reasons to Invest in Life Settlements

There are plenty of reasons to invest in life settlements. This alternative investment has developed due to a unique necessity. In fact, it has caused a positive impact for both institutional investors and the insured individual. The prolonged low-interest-rate environment is forcing investors to embark on paths away from traditional assets as they seek a […]

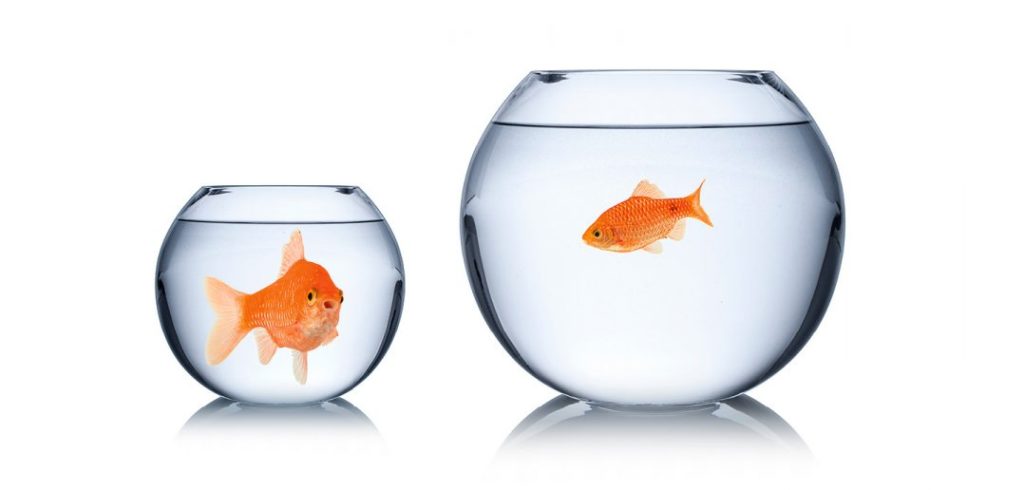

Performance Cycle in a Life Settlements Portfolio

Understanding the life settlements performance cycle is the key to a successful investment campaign. From a manager’s perspective, this is also vital in managing client expectations. Although the asset has many non-traditional investment features it still does operates within a “cycle” of sorts. Like any asset class, life settlements provide certain potential excess return opportunities […]